LSD Strategy

Last updated

Last updated

The initial use case for Locust is the provision of liquidity for LSD pools. LSD tokens, both rebasing and non-rebasing, centre around a Redemption Rate which moves only slowly with time.

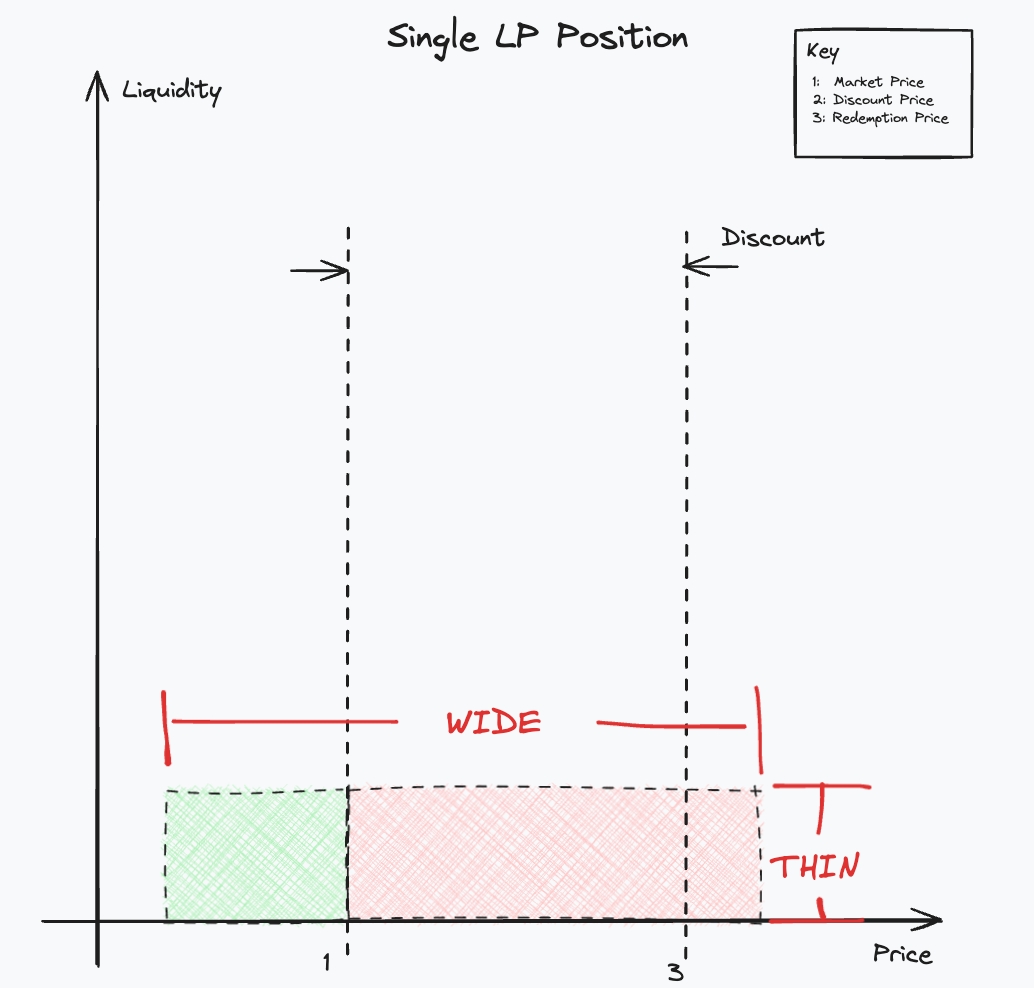

In a typical single position LP strategy liquidity will typically be placed at a wide range either side of the redemption price. However, to stay in range most of the time liquidity is supplied wide and thin which is capital inefficient.

In order to remain in range as much as possible LPers will buy and sell assets at the market price regardless of the discount with respect to the actual redemption price.

Not only does this cause liquidity to be thin but also means that LPers are likely to experience Impermanent Loss (IL). Not only this but for the redemption and market prices to be restored the same amount of liquidity will need to be traded in the opposite direction.

Furthermore, IL is not truly permanent as with the change in redemption rate a previously held "peg" may not be restored.

Locust does not take this approach, rather it utilises the limit-orderbook feature of CL pools and actively manages positions for LPers. The LSD strategy takes the view that the assets held should be sold for the right price and not rely on pure arbitrage to return the peg if we can do better.

The Locust strategy can be simplified to "Buy low, sell high" as the strategy minimises the assets being sold at a discount. For example in Scenario A below the strategy removes all liquidity between the redemption rate and the market price.

The LP positions thus only buy for the cheaper price and sell for the higher. This has a number of consequences:

Reduction in amount of liquidity required to return to peg

Ability to deploy liquidity in a more capital efficient manner

Increased profitability

Further the Locust strategy listens to all pool events and reallocates assets, meaning that assets bought at the market price are then immediately redeployed to the higher price position.

This also enables liquidity to be provided concentrated and deep.

As there is much less liquidity between the redemption and market prices Scenario B will be achieved much more easily.

In conclusion we should how Locust reactive vault strategies can improve the efficiency of LPing LSDs. However, the same tools and techniques can be applied to other markets.

Given we wanted to create an LP position for the CL pool of lsdASSET<>ASSET in market defined:

Market Price: 1.0

Redemption Price: 1.1

Position is fixed with 10%:

Position:

Lower Bound: 0.9

Upper Bound: 1.1

Asset 0: 100

Asset 1: 100

In this scenario in order to return the market to the the redemption price you would need to sell 100 asset 1 at a clearing price of 1.05 thus incurring a 5% loss as compared to redeeming the assets directly.

Additionally the liquidity needed to return the price to the redemption price would be ~105 asset 1.

Now consider a Locust strategy as follows:

Strategy:

Spread: 2%

Discount 1%

Quote Position:

Lower Bound: 0.98

Upper Bound: 1.0

Asset 0: 0

Asset 1: 100

Base Position:

Lower Bound: 1.09

Upper Bound: 1.11

Asset 0: 100

Asset 1: 0

Thus in order to return the peg negigible assets are required. Furthermore, any liquidity sold would be done so at a maximum discount of 1%, which is a considerable saving over the fixed width vault strategy above.

Furthermore any liquidity sold at could then be placed into the base position and sold at a profit of ~9%.